Public accounting is a critical service. Individuals and businesses will always need help navigating tax laws and filing taxes. Businesses and other organizations will always need a second set of eyes for audit work. The public relies on certified professionals to protect their individual and business interests specifically, Certified Public Accountants.

The distinction of Certified Public Accountant is earned, not freely given. The key component to adding that title to one’s name requires candidates to pass the Uniform CPA Examination––the CPA Exam.

What is the CPA Exam?

The CPA Exam, created and graded by the American Institute of Certified Public Accountants (AICPA), is a collection of four tests, each focusing on a particular concentration vital to the accounting profession. These tests assess a candidate’s knowledge and competency in accounting, auditing, business law, individual and organizational taxation, and accounting ethics.

The four sections are as follows:

- Financial Accounting and Reporting (FAR): The FAR section focuses on financial accounting, reporting, fundamental accounting principles, and preparing financial statements. Candidates prove their understanding of Generally Accepted Accounting Principles (GAAP), International Financial Reporting Standards (IFRS), and accounting for business transactions.

- Auditing and Attestation (AUD): The AUD section deals with auditing in and out of the field. Candidates prove their understanding of preparing for and performing audits and demonstrating the correct procedures for documenting their findings.

- Business Environment and Concepts (BEC): The BEC section revolves around business, economics, and management. It tests a candidate’s knowledge of business structures, financial management, and the global business environment. Information technology, corporate governance, and risk management are also covered in this section.

- Regulation (REG): The REG section focuses on business law and tax regulations. Candidates need to prove their understanding of federal taxation, business law, and accounting ethics. Topics such as individual taxes, estate taxes, gift taxes, and entity taxes are covered in this section.

Each section has a set time limit of four hours. And now, in a historic rule amendment that took place this April, candidates have 30 months (instead of 18) to pass all four sections. Candidates can choose to take the sections in any order.

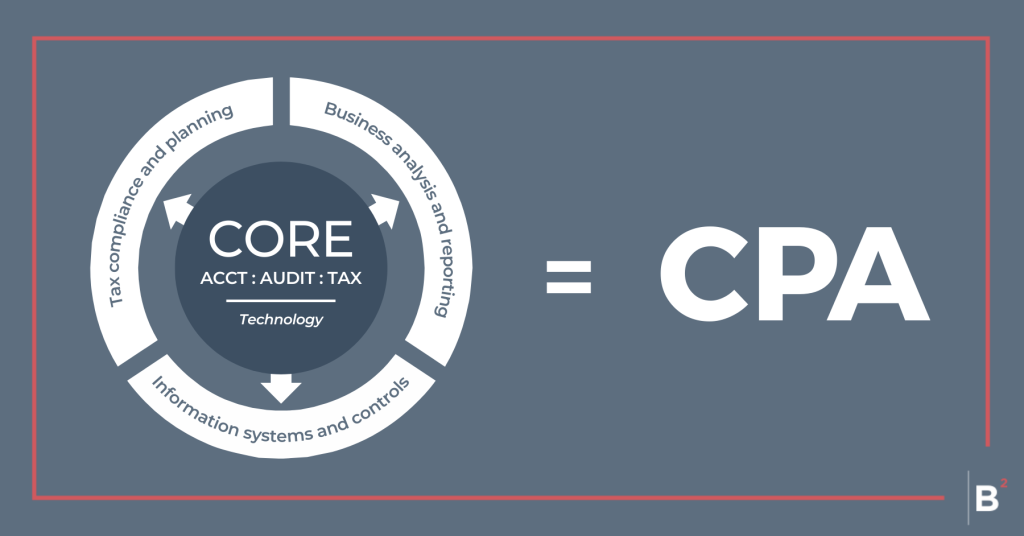

*Breaking News: The following changes to the CPA Exam will be effective January 1, 2024. The “Core Sections” consisting of AUD, FAR, and REG will remain the same, but the BEC section will be broken into three different tests: Business analysis and reporting (BAR), information systems and controls (ISC), and tax compliance and planning (TCP). In addition to the three unchanged core sections, CPA candidates must choose one of the three aforementioned “discipline” sections which reflect the three pillars of the CPA exam.

Preparation

The CPA Exam is a monumental undertaking, often requiring months of preparation. With an average pass rate of around 50%, candidates should treat CPA Exam preparation as a full-time job. As with all exam formats, a strategic approach leads to more effective preparation.

Here are a few tips:

- Be prepared to answer both multiple-choice questions and simulation questions.

- Don’t expect multiple-choice components to be straightforward – many require picking the best answer among many good options.

- Simulation questions require candidates to perform specific tasks or complete related tasks such as reviewing financial statements or proofing audit documentation to identify discrepancies. Prepare to do actual accounting work, not just answer accounting questions.

- Note the four-hour time limit for each exam––it’s a simple step, but managing test anxiety can make or break an attempt at one of the CPA Exam sections.

- While expensive, CPA Exam prep courses and practice exams can help candidates focus their study practices on the right material.

- Keep fees in mind. Prices vary by state, but fees for each section of the CPA Exam generally range from $100 to $300.

- Seek support from accounting professionals, the applicant’s State’s Board of Accountancy, and peers who have passed the CPA exam. These individuals can offer advice and guidance specific to their state’s requirements and relieve anxiety through first-hand accounts.

What You Gain

A CPA license is only sometimes necessary to work as an accountant. However, Borland Benefield and many other firms strongly encourage those interested in the field to attempt the CPA Exam.

To aid in career advancement, Borland Benefield will sponsor an associate’s costs for study materials and up to four attempts of the exam – one attempt per section.

The CPA license is a badge of honor signifying that an accountant meets the education and experience requirements to operate in such a meticulous field. It also demonstrates a high level of competence and drive, opening up future possibilities and career opportunities.

Our Investment

Borland Benefield is firmly committed to the professional advancement of our members. As a part of our team, employees are compensated for their Becker CPA exam preparation and study materials, as well as exam registration fees.