In a previous blog, we covered a few ways to teach children the importance of financial literacy. We went a step further and reviewed a handful of financial apps that are great tools to help parents teach their children about finances.

Here are four of our favorite apps.

The Game of Life / The Game of Life 2

$2.99 for each app

This classic board game and its sequel ditched the cardboard, cards, and plastic pieces and made the leap into digital media.

This classic board game and its sequel ditched the cardboard, cards, and plastic pieces and made the leap into digital media.

It might not seem like a teaching tool for future finances, but by introducing your children to money management and how to think strategically about future planning, and the financial consequences of decisions, you can begin to build up a base of knowledge for your child to draw from later.

Introducing the dos and don’ts of money management with a fun night of games can open their minds up early and give parents a teachable moment to discuss finances.

$2.99

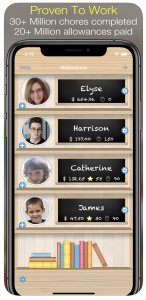

iAllowance is a great way to track allowances once your children reach that age where they need some spending money. It’s simple and can be synced between you and all your kids, taking the chore out of keeping up with the chores.

iAllowance keeps track of your children’s activities through a star system: they complete items and earn stars. You can then see which chores have been completed and pay them accordingly.

iAllowance is an affordable, effective visual representation to show your children how much they’ve worked – and how that work earns them money. Plus, it reinforces the concept of saving money, ensuring that children will be better at building up those rainy-day funds later in life.

$3.99 per month

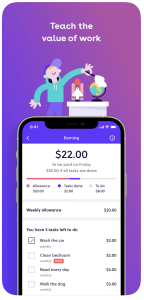

Teenagers need some financial freedom. There’s gas for the car (when they finally pass that driving test), mall trips with friends, meals, and online purchases.

But they don’t need TOTAL financial freedom.

GoHenry operates through an app-debit card combo. You can set spending limits on the card, ensuring teens won’t blow through all their money in one outing. GoHenry also protects teens from overdraft penalties, so you don’t have to worry about a .99-cent gum pack costing them $25 if their account runs dry.

As the parent, you can set spending rules through the app and set up a direct deposit for those first paychecks they’ll be earning. You also receive real-time alerts for certain spending purchases, and you can even choose where your teens are allowed to spend money.

GoHenry gives teens financial autonomy while providing parents with a firm handle on their spending habits.

$3.00 per month for one user

$5.00 per month for family

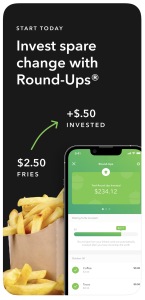

Investing in stocks is the next step for your children’s financial education. Acorns is one of the most popular tools to help them take that step.

Acorns owe their popularity to the “Round Ups” feature. Round Ups add the remainder of partial-dollar purchases (5 cents on top of a $1.95 purchase, for example) and automatically invests them into a diversified stock portfolio.

It’s interesting to note that Acorns has started integrating cryptocurrency into their portfolios through Bitcoin-linked ETFs. Up to 5% of investments can be allocated to crypto, further diversifying earnings potential.

Play Along and Help Them Learn

It’s hard for children to learn about money on their own. As the saying goes, “parental guidance is suggested.” Use these apps as a tool to start a conversation and help teach your children smart money habits.

GoHenry

GoHenry

Acorns

Acorns